“Monti di Pietà”

Publication by Tanja Skambraks and Annette Kehnel in the magazine of the German Research Foundation (DFG) (forschung, 3–4/2022)

In their article entitled “Berge der Barmheirzigkeit” (engl. “Mountains of Piety”), Tanja Skambraks and Annette Kehnel describe early forms of sustainable action using the example of the Monti di Pietà. In this context, they also present the DFG project “Small-scale credit and market participation”, which reconstructs, among other things, the history and practice of small-scale credits in Italy in the late Middle Ages, based on medieval sources and close to everyday life. These financial injections had nothing to do with charity, however, but with the culture of well-organised pawnbrokers.

Please find the article here.

IMC Leeds 2021, 5.-9.7.2021

Inventories and Last Wills as Sources for Credit Activities and Credit Networks in Late Medieval London and German Hanseatic and Lower Rhine Cities

8. Juli 2021, 10:00 Uhr – Session 1524: Inventories and Last Wills as Sources for Credit Activities and Credit Networks in Late Medieval London and German Hanseatic and Lower Rhine Cities

Sponsor: German Research Foundation: Project “Small-scale credit and market participation”

- Markus Schniggendiller: Inventories and Wills as Complementary Sources for the Credit Activities of St Paul's Canons

- Monika Gussone: Credit Practices and Credit Networks in Late Medieval Lower Rhine Cities as Apparent in Inventories and Testaments

- Hiram Kümper: Private Debt and Credit Networks in Hansa Cities: The Value of Last Wills

Focusing on north-western Europe (north-western Germany, England), members of the DFG research project “Small-scale Credit and Market Participation” focused on the ubiquity of credit in pre-modern societies at the IMC (International Medieval Congress) Leeds . The section discussed the value of wills and inventories as sources regarding information on credit relations and practices.

Death was the ideal opportunity for renegotiating credit relationships and settling debts. This is illustrated by wills, a source genre that reveals more about credit than might initially be expected. This is an extremely valuable discovery, as the lack of sources has traditionally been one of the major problems in the study of medieval small loans. These were often granted informally and thus rarely recorded by pragmatic writing, or their documentation was destroyed directly after repayment. On the one hand, wills and inventories provide information about such informal loans; on the other hand, they provide insight into social and economic relationships as well as credit practices. Their potential for evaluation in the study of medieval credit relations was the topic of the three presentations, all of which approached the sources from a different perspective. All speakers demonstrated the value of these sources through material-saturated studies. The first presentation showed how inventories can be used as a complementary source to other types of sources, such as court records. The following presentation demonstrated how credit practices can be reconstructed using inventories and wills. Finally, the last presentation dealt with how the potential of serially transmitted wills can be used for the possible research of credit networks.

In addition to a large number of surviving court records of the Court of Common Pleas, wills and inventories provide a much deeper insight into the credit activities of the clergy of St. Paul's, as Markus Schniggendiller first made clear. Using the will of a 14th century London bishop, he illustrated different practices of lending and showed that people of high social status were part of the credit networks not only as creditors but also as debtors. Furthermore, he revealed credit relations between the canons of St. Paul's and the poorest of the London population by presenting the inventory of the household of Helen Walssh, the widow of a mariner.

In her talk, Monika Gussone used wills and inventories from small towns in the Lower Rhine region to reconstruct credit practices. Estate inventories sometimes reveal the complete credit relationships of a deceased person and his or her spouse at the time of death. The names of all credit partners are mentioned and, moreover, almost all of a person's mobile assets are listed. It is also not uncommon for wills written at the end of life to reveal numerous credit relationships. The death of a person was an obvious time to renegotiate credit relationships and settle debts. But settling debts during one's lifetime was recognisably not a high priority. This task was left to the heirs or specified in the will.

Afterwards, HIRAM KÜMPER discussed, among other things, common practices in the wills of various Hanseatic cities. In some cases, testators released debtors from their debts, in other cases they ordered their repayment to one of the heirs or to an ecclesiastical institution. In his talk, Kümper emphasised a decisive advantage of wills and inventories: they provide information about informal loans, which were usually very small in terms of value and were often granted to family members. Therefore, they are rarely mentioned in notary registers or similar, but are crucial for research on the dynamics of pre-modern societies. The use of digital methods to explore large amounts of data could prove to be a helpful tool in this regard.

Combined with other source genres, wills and inventories provide essential information on the social and economic relationships of people in the late Middle Ages and thus allow deep insights into medieval credit behaviour. People from all social strata were to be found both as debtors and creditors in the credit networks – credit was omnipresent. This is demonstrated not least by the three papers in the section “Inventories and Last Wills as Sources for Credit Activities and Credit Networks in Late Medieval London and German Hanseatic and Lower Rhine Cities” at this year's IMC Leeds.

International conference at the Heidelberg Academy of Sciences, 28.-30.10.2019

Change and Transformation of Premodern Credit Markets: The Importance of Small-scale Credits

This interdisciplinary conference focused on the development of credit markets to mobilize large amounts of capital in the medieval and early modern period. It combined both economic and historical research for investigating premodern credit practices. The proceedings of the conference will be published by HeiBooks in 2021.

The program of the conference can be found here.

A conference report is published at h-soz-u-kult.

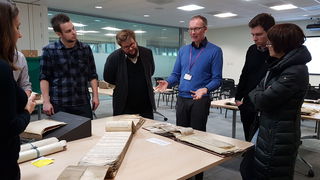

“The Materiality of Debt” – Workshop at the GHI in London, 29.11.-30.11.2018

The workshop in London was dedicated to one aspect of the ongoing project, namely the materiality of debt. A particular focus was on the materiality of sources and their handling for the study of credit and debt relations; the contributions dealt with diverse aspects of credit history.

The keynote speech “Village Credit in England, 13th-15th centuries” was given by Chris Briggs (Cambridge) and demonstrated the problem of the transmission of medieval small credits using the example of the Manor Court Rolls in England. Briggs' presentation showed that despite the difficult source situation for rural areas and the few surviving sources, the Manor Court Rolls, the research of rural small-scale credits is possible. The results impressively showed how strongly rural areas were already penetrated by the credit principle in the Middle Ages.

The lecture by Stephan Köhler (Mannheim) “New Sources for Old Stories – The Materiality of Borrowing and Lending Money in Tyrol during the 13th and 14th Centuries” dealt with the question of the significance of research on premodern credit practices for discourses on economic history. Using the credit economy in medieval Tyrol as an example, it was shown how different sources on the credit economy (notarial imbreviations, rait books, court records, pawnbrokers' notes of sale) document different aspects of pre-modern economic activity and thus demonstrate the versatility of medieval credit markets.

Markus Schniggendiller (Mannheim) presented the first results of his research project “Credit Networks and financial Involvement of the Clerics of St Paul`s Cathedral” , which is based on research on the economic activities of the clergy of St Paul`s Cathedral in the late Middle Ages. It is precisely that these extensive credit transactions of the canons of the metropolis of London have not been systematically investigated so far. The results promise to provide exciting insights into the interconnectedness of credit relationships between cathedral clergy and city dwellers.

The last two lectures dealt with cities in north-west Germany. Jan Siegemund (Dresden) presented in his paper “Different Kinds of Credit in Late Medieval City Accounts: The Example of Bocholt (1407-1420)” how city account books were used as instruments for credit relations. Based on the genre of the account books, Siegemund was able to find credit relationships that had not otherwise been handed down, thus revealing valuable insights into urban credit relationships.

The last contribution by Monika Gussone (Mannheim) entitled “City Accounts and complementary Records as Sources for small Credits granted and received in late medieval Wesel and Kalkar” took up the topic of the urban credit economy. Using the examples of Wesel and Kalkar, the speaker was able to show that researching credit practices beyond the city limits is a worthwhile endeavour and that only the consideration of reciprocal relationships between different cities allows for a complete picture.

All the lectures showed, based on their respective case studies, that credit transactions took place on several levels. However, in order to grasp this complexity of credit markets, a special consideration of the materiality of the sources is necessary – including the consideration of those written materials that we would not primarily associate with credit transactions today. The conference was concluded by a workshop at the National Archives in Kew on sources on credit and debt relationships in medieval England.